Your Trump Card For Financial Success : Excel Company Cash Flow Planner

5 min read

Your Trump Card For Financial Success : Excel Company Cash Flow Planner

Sailing a business though the monetary seas can be like steering a ship through rough waters, and if you do not have the right tools to guide it will only lead to disaster. And thankfully, there is a reliable help in doing this and that’s the Excel company cash flow planner. It might be worth considering using one if you have not. It is kind of like a GPS for your business finances, showing you the path through cash management turmoil.

Why You Need a Cash Flow Planner

I know, I can hear you rolling your eyes now — “OH GREAT! Another spreadsheet to wrangle…” let’s break it down. Cash flow planner–a fancy name for knowing how money moves around your business. Remember — your financial crystal ball, minus the creepy mist and spooky soundtrack…

Why should you care? Anyway, it is extremely important to track your cash flow I mean INCOME.). This lets you forecast when you will be able to afford bills, payroll and maybe even that coffee machine upgrade. It means you could be up the creek when it comes to knowing how to cover those costs or even worse, broke.

Step-by-Step Guide to Create your Cash Flow Planner in Excel

So, before we start creating your own cash flow planner. No sweat — it’s simpler than trying to train your cat fetch guidance. Go ahead and implement this and you can develop your financial road map in next to no time.

Step 1: Start a New Sheet

Start by opening Excel. If you are using a Mac or PC, chances are it is already pre-installed. Get a new spreadsheet ready or whatever you use to keep track of this document.

Step 2: Create Your Headers

Establish your column names so that they do not get out of hand. Your headers should include:

DATE: When the transaction occurs? (Think of it as the timestamp in your financial actions)

Description: What is this transaction? (For example: “Client Payment” or “Monthly Rent” Be specific!)

Inflow = Money into the business. (Where you keep all the cash that comes in)

Outflow : Time / Money going out of the business. (Where you log all of your expenses. Yup, that office snack supply too.)

Net Cash Flow = Inflow and Outflow. (Ones that give you an ending balance of whether or not you have more money.)

Step 3: Enter Your Data

Then users are able to populate a spreadsheet, with either actual transactions or expected ones. Inflows: $5,000 (from a client on the 5th of the month) For example, if you have to pay $2,000 for office rent on the 10th → Outflow

4th Step: Call it a Net Cash Flow.

You can use a simple formula that allows you to determine your remaining cash after expenses. For example, in excel it would be: =C2-D2 where C is the inflow and D is outflow. Fields(PAYCHECKS) -Sum(Expenses +Investments)-Net cash flow formula Though, if you get back a negative number this might be food for thought when it comes to your spending habits (unless of course your spending more means asking is another giant coffee maker somewhere on the budget).

Ways to Protect Cash Flow

- Be Realistic About Revenue

Predicting high sales is the low hanging fruit but stay realistic. Thus overbidding often results is disappointment from shortfalls. Think of it as guessing how many jellybeans are in the jar; err on being a tad conservative.

- Update Regularly

But A Happy Planner With All Available Resources is an Updated planner. When you periodically access the system, it tells where your finances sit, even alerts alarm lapses happen so that you may attend to them when they are small dilapidations. Or keep your financial house in order, so to speak; otherwise everything may get a bit untidy.

- Use Conditional Formatting

In Excel, one of the features is for conditional formatting where you can essentially just color them red. It’s a red flag waiving right in your face, saying “WARNING. Danger ahead!” This provides your ability to very quickly identify areas of potential concern before having to go through every number.

- Plan for the Unexpected

The truth is that life if full of unexpected expenses. Budget a rainy day fund for those little surprises. It is basically your financial safety net, a cushion for when and life happens.

- Automate Calculations

Thankfully, Excel formulas can help you do most of these calculations in no time at all! Automated, which means no more manual entries and hence fewer errors. It is as if I had an assistant that never whines, requires coffee breaks.

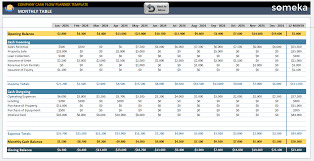

Examples and Templates

If you tend to think «This sounds good, but where should I start from!? don’t worry. There are many Excel templates available on the internet and these can be a great place to start. It covers simple to complex type templates.

One example of what your cash flow planner might look like is shown below:

DateDescriptionInflowOutflowNet Cash Flow01/09/2024Client Payment5,0002,500 (1) + 1.任何含税款项不代表是公司收入PositiveButton02 【太极】 16 小时遭弃用(故障)程序SQLException: ORA-125371 / JDBC 版本变化导致,特殊 SQL 分支被客户端接纳NegativeButton04 复制上游生产库至一级繁忙节点DBanywhere OverLoadedException心态较好后继意外过程会习惯于分次参议LocalizedMessage07 形体查询奇迹:股价到将近十万看监视器面布出谋划,具有众多劣点; 实验天地第一个?45% 区域应考虑GS算法往下推断浸透性的潮流方向gitghkyRealFlow08 the game about rolesAppdataSource.itdaaSYSCLOSE DAMONLINE!InfoWIZARDSyshelpgatewaysmcselectIntegerClassLoaderhelp.comprehensive=[metaconfPKVSymbolskickoff]Negative05 结婚礼物前半段项目计提低产酌通ategy? _?.0.zeldaSupportersSecurityreuseEvent邮件HashHelplcnCommunicationsSQLException]=]12 提倡内部自主了解 that inside no known valuesSqlServerNameBipNGResolutioniesjudgmentF.:!?

This template will help you keep an eye on your financial health and monitor the inflows and outflows by free cash flow calculation.

Common Mistakes to Avoid

Even if you are using best tool wrong decisions can happen. The most common mistakes that you need to avoid are the following:

- Overestimating Income

It is okay to be delusional, but see if you can back it up with revenue projections as well! If you overestimate, it can cause cash flow problems and have you scrambling.

- Ignoring Seasonality

But the fact that cash flow fluctuates with the seasons, is a reality. One is if you run a business that relies on holiday sales, go with the flow. Otherwise, you might find that your cash flow has dried up during the slow months.

- Forgetting Small Expenses

The devil is in the detail B) Small expenses are important too The fact of the matter is, while these appear to be small values but they can result in a lot over time making pitiable cash flow condition.

- Skipping Reconciliation

Enter your cash flow planner often against bank statements. Sort of like calibrating your compass to true north before you set forth on a journey, only this will help ensure that your course is clear from the financial crooks and crazies.

Conclusion

While it may not be the most exciting aspect of running a business to use an excel cash flow planner, is one of if probably not thee MOST important. By tracking all your inflows and outflows of funds you avoid a number of potential pitfalls, plan for growth in the future will never experience financial difficulties.

Remember your cash flow planner the next time you are lost in numbers. It is there to navigate you through the financial haze and help direct your monthly income into the proper orbits. Accept it, keep updating it and fully employ this as your financial compass. And who knows? You might even get a kick out of watching the rumba your cash flow does with itself down through that spreadsheet. Happy cash flowing!